Even as California moves to address regulatory obstacles to fair, actuarially sound insurance underwriting and pricing, the state’s risk profile continues to evolve in ways that impede progress.

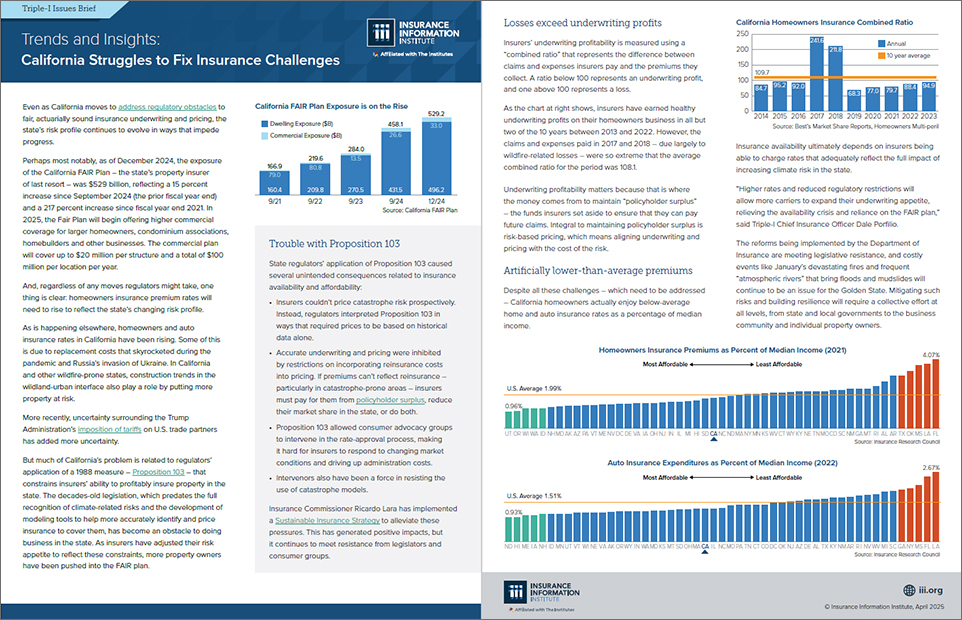

State regulators’ application of Proposition 103 – a three-decades-old measure intended to keep insurance affordable for Californians – has caused several unintended consequences related to insurance availability. Insurance Commissioner Ricardo Lara has implemented a Sustainable Insurance Strategy to alleviate these pressures. The strategy has generated positive impacts, but it continues to meet resistance from legislators and consumer groups.

Regardless of any moves regulators might take, however, one thing is clear: California homeowners’ insurance premiums have been held artificially low and will have to rise to reflect the state’s changing risk profile.

(As of April 10, 2025)

Click here to download full version of Trends and Insights: California Struggles to Fix Insurance Challenges.

Previous Trends and Insights: California